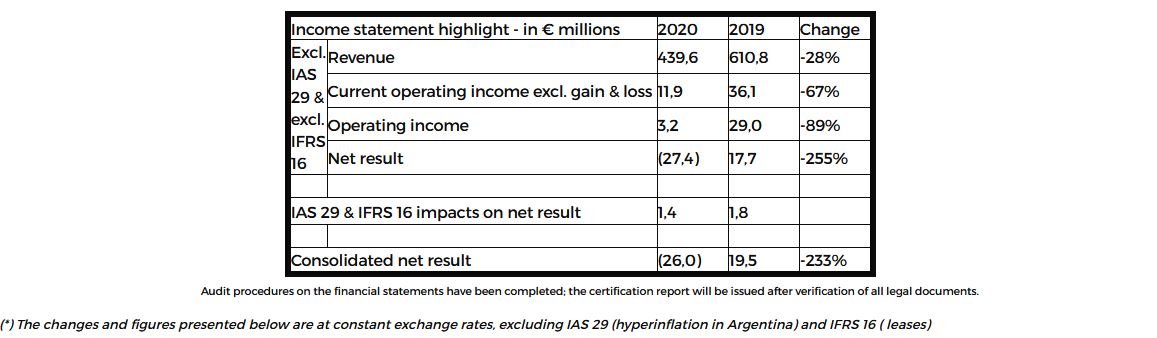

In a global market strongly impacted by the health crisis, where only China is showing growth compared to 2019, Haulotte's cumulative 2020 sales amounted to € 439.6 million compared to € 610.8 million in 2019, a decrease of -27% (at constant exchange rates) between the two periods.

Over the year, the Group finally posted a current operating income of € +11.9 million (excluding foreign exchange gains and losses) or +2.7% of revenue, down -67% compared with 2019. The improvement observed during the second semester is mainly explained by a better control of the fixed costs, without any restructuring or impact on the Group's strategic projects.

Despite this, in line with the results published in the first half of the year, net profit was € -27.4 million, significantly impacted by cumulative foreign exchange losses of € -17.8 million (including € -14.1 million of unrealized losses) due to the continued strengthening of the Euro against the vast majority of currencies, in particular the US dollar and Latin American currencies, as well as an additional € -4.3 million impairment on North American CGU goodwill .

Against this unprecedented backdrop, Haulotte took the necessary adjustments to reduce its working capital requirement over the year by € -35.3 million, driven by a sharp drop in inventories (€ -49.2 million). Despite this, the Group's net debt (excluding guarantees and IFRS16) increased by € +11.6 million in 2020 in a context of continued strategic investments.

As a reminder, Haulotte had obtained a waiver from all the lenders of the syndicated loan, unanimously and unreservedly, on June 30, 2020, concerning compliance with the ratios for two periods (June and December 2020), and a one-year extension of the syndicated loan contract, extending its maturity to July 17th, 2025.